Anatomy of a transaction

To initiate a transaction, a merchant will display a QR code that we call the QR-m (m for merchant). You scan it with your smart phone and can see everything: QR-m codes contain at least the merchant name, transaction identification, and the amount. Nothing is hidden from you.

When you approve the transaction, the NC3 app generates a QR code we call QR-c (c for consumer) that your merchant will scan. Unlike the QR-m, the QR-c uses advanced encryption to protect your NC3 account identifier, approval, and the transaction details. Merchants process the QR-c the same way they process charges today and the transaction winds up at your provider (who can read the information).

The merchant gets their charge approved, but your charge card information is not part of this QR code; even if the QR code is compromised, the crooks can’t get what isn’t there.

We use these symbols to indicate QR-m and QR-c codes:

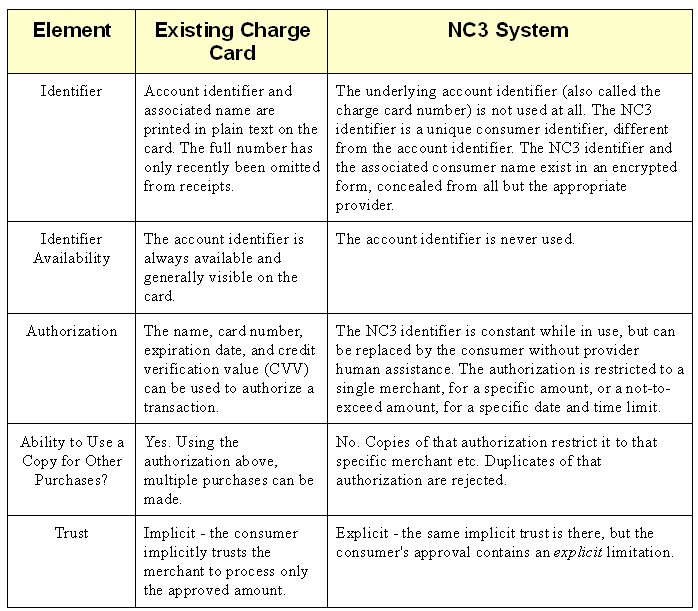

NC3 separates the charge authorization from the account identifier

NC3 creates an encrypted account identifier and a dynamic, transaction-specific charge authorization, protecting your account from unauthorized use.

NC3 Requirements

For consumers: Smart phone with a camera and the NC3 application. No internet access is required to complete a transaction.

For merchants: Smart phone with a camera and NC3 software. No additional hardware required. No internet access is required to complete a transaction.

For providers: NC3 works in the existing infrastructure, so implementing NC3 is low cost.

Examples of NC3 in use