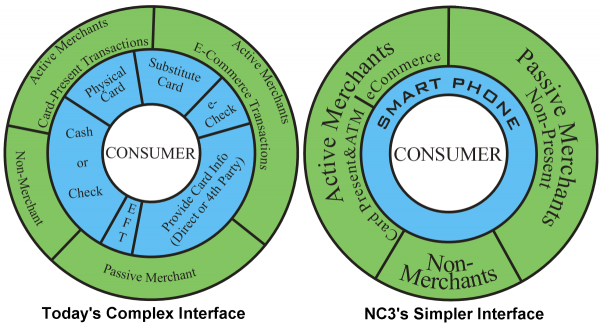

NC3 gives you what you can’t get from today’s charge, debit, or credit cards:

More convenient for you

Sure, your charge cards are convenient already, to the extent that you can use them just about anywhere. But fumbling through your wallet to get your card, dealing with malfunctioning or cracked swipers and dead magnetic strips? Not so much. With NC3, all you need is your phone.

Pay your utility bill by surfing to your payment site, or use your phone.

Buy a gift online by giving the merchant your charge card number (which can be

compromised), or use a 4th party payment clearinghouse, or use your phone.

Settle your restaurant bill by giving them your charge card (which can be copied by anyone who has it for even a few minutes), or use your phone.

No matter who you’re paying, or for what, or how you got the bill, you just scan, approve, and pay.

Kinder to the environment

Today, you get a printed receipt with most transactions, whether you want it or not. Those printed receipts make up 22.87 million pounds of paper used each year, and may very well be contaminated with BPA.

We won’t even get into the environmental impact to the non-renewable resources used to manufacture all that paper. With NC3, you can still get your receipt – electronically. Sure, we may inconvenience a few zillion electrons, but you’ll be saving trees.

Peace of mind

When you make a purchase using a charge card, you share all your card information with the merchant: in essence, you’re providing an account identifier and an open authorization. With a name, account number, expiration date, and CVV code, the card can be used by nearly anyone for nearly anything (how often do merchants actually check your ID when you make a credit card purchase?). Even if the merchant is trustworthy, their security can be compromised, placing your information at risk. NC3 technology has none of the drawbacks of RFID, NFC or EMV/Chip&Pin. With NC3, your charge card information is never shared with the merchant or their employees. What they don’t have, they can’t compromise. Your information is secure.

NC3, Commerce … evolved

First we had the barter system. Then we invented currency. We wanted a little more security and convenience so we invented personalized checks. Then we got the store-specific charge card and finally the generalized charge card. Like all the systems before them the generalized charge card has its problems. The card itself contains all the information an industrious crook needs to misuse them.

NC3 gives consumers the same convenience and utility as a charge card (or cash), but with the same kind of personalization and time sensitivity as bartering. NC3 basically lets you create your own money in the precise amount you need, and lets you make that money good only for the merchant you say, only for the amount you say, only for one use, and only for a limited time. The convenience of cash with more security than any form of commerce we’ve used before. NC3 is commerce… evolved.